Solana Gains Traction as Institutional Investors Step In

Solana’s price has surged past $240, bolstered by significant interest from institutional players. This recent climb reflects robust momentum, marking multi-month highs.

Pantera Capital and Helius are notably increasing their SOL holdings.On September 16, Solana traded around $234.85, though it had peaked at $249.12 just a couple of days prior. Even with some correction, the trend remains upward.

- Helius announced a $500 million treasury plan, linked to a private equity deal.

- Pantera’s founder,Dan Morehead,revealed a $1.1 billion investment in SOL, highlighting it as their biggest bet.

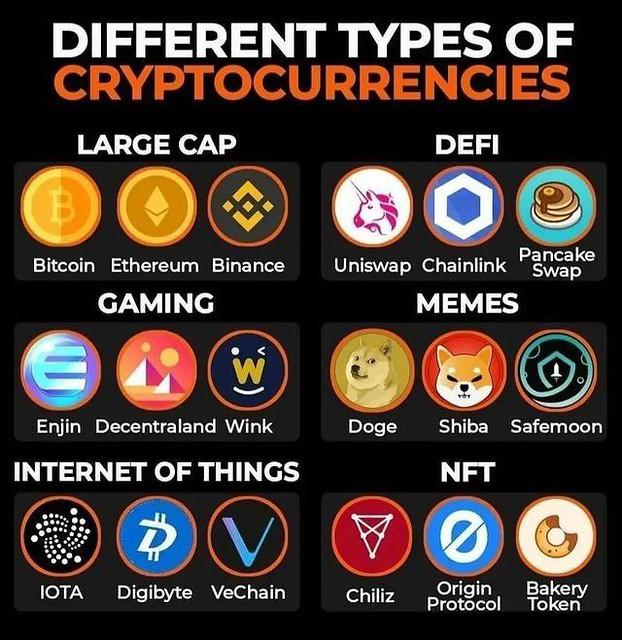

DeFi activity on Solana is also heating up, particularly for memecoins.For example, Pump.fun hit over $1 billion in daily trading volume amid a broader memecoin rally.

Noteworthy memecoins like pudgy Penguins (PENGU) and Bonk (BONK) showed growth rates of 4.0% and 3.9%,respectively. As the Fed considers rate cuts, risky assets like Solana and memecoins stand to benefit.

With Bitcoin nearing record highs, traders are shifting to altcoins seeking greater returns. solana profits doubly: its price rises, and its DeFi ecosystem expands, attracting more locked value.