Crypto Market Poised for Bullish Turn as Fed Cuts Loom

The cryptocurrency market could soon see a notable upturn. Recent weak job numbers have led many financial experts to predict that the Federal Reserve will reduce interest rates at its next meeting.This forecast, combined with approaching deadlines for altcoin ETF approvals, signals potential growth for digital assets.

The U.S.Department of Labor reported disappointing employment figures for august, showing only 22,000 new jobs added and an unemployment rate increase to 4.3%. Such data strengthens the case for Fed rate cuts. Polymarket and CME FedWatch tools indicate a probability ranging from 88% to 90% for a 25 basis point decrease. Some economists think a 50-basis point cut might happen.

Mohamed el-Erian, as an example, stated that the weak report underscores a delayed Fed reaction, suggesting a stronger action like a 50-basis point cut could occur next month.

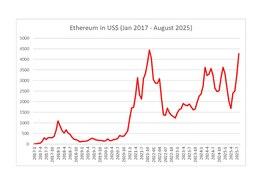

Following these indicators,major cryptocurrencies like Bitcoin ($110,865) and Ethereum ($4,285) jumped in value. The overall crypto market reached $3.9 trillion. Historically, digital currencies do well during periods of rate cuts, much like during the COVID-19 pandemic.

Around the corner looms another significant factor: ETF approvals. Regulators have set October dates for various proposals,includingGrayscale on Oct. 18, 21Shares by Oct. 19, andBitwise by Oct. 20. There are also deadlines for XRP-related ETFs fromWisdomTree, CoinShares, and Frankin Templeton. The SEC has slated other coin approvals, such as dogecoin, Litecoin, Solana, and Cardano, all for later this month.

These developments hint at a wave of ETF approvals in October,which could boost coin prices. Recent trends show a hunger for crypto ETFs, with Bitcoin and Ethereum funds breaking $67 billion in investments. This enthusiasm is mirrored by the CME XRP futures exceeding $1 billion in contracts.