Janover’s Crypto Pivot: From Real Estate Loans to Solana Validator Network

Janover (JNVR), a small software company, has made a surprising move into the crypto world. The firm, which connects real estate borrowers with lenders, announced a new digital asset strategy focused on Solana (SOL).

On April 7, a group of former Kraken executives acquired a controlling stake in Janover and raised $42 million in funding. The company plans to rebrand as DeFi Development Corporation and hold Solana’s SOL token as its core treasury asset.

Before the announcement, JNVR traded at $4.44. After the news, the stock surged to $48.47, marking a brief 1,000% jump. It ultimately closed at $40.25, reflecting an 842% gain on the day. trading volume also spiked from a few thousand shares to over 25 million.

Janover was founded in 2018 by Blake janover. It initially focused on financial technology in the commercial real estate space. The company went public on NASDAQ in July 2023 under the ticker JNVR, raising $5.6 million at $4 per share.

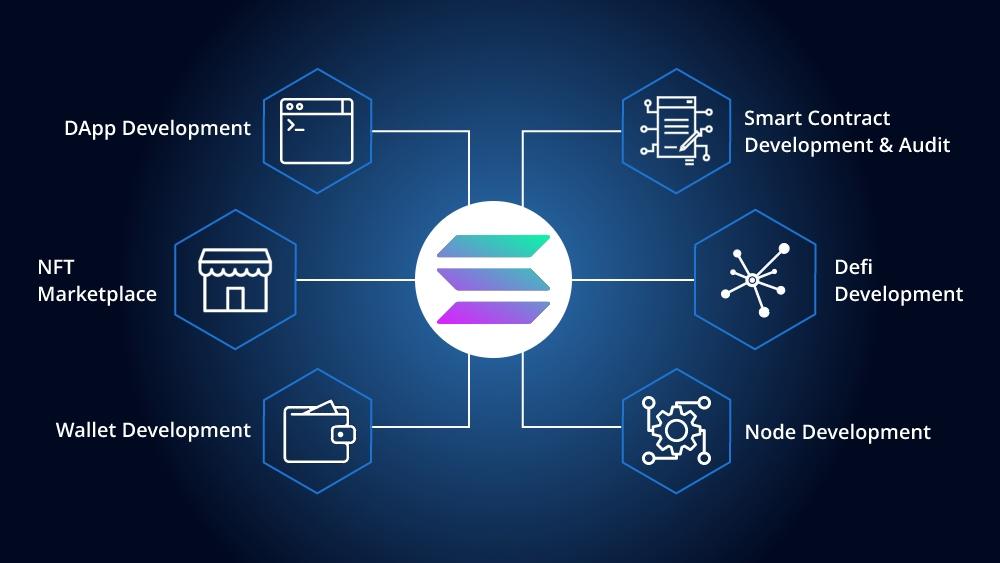

The new direction centers on holding Solana’s SOL token as its primary treasury asset. Janover now plans to operate validators directly, allowing it to generate yield while building stronger technical and operational alignment with the Solana network.

Janover’s crypto-focused overhaul has sparked importent interest from retail investors. The company’s strategic reorientation and new direction have led to a massive stock jump and increased trading volume.

Janover Embraces Crypto with New Leadership and Strategy

Janover is making a bold move into the crypto space. The company is acquiring Solana (SOL) and participating in validator operations.This shift is led by a new executive team with deep crypto experience.

Joseph Onorati, the new Chairman and CEO, comes from Kraken. He told CNBC that Janover will start buying SOL and running validators right away. Parker White, now CIO and COO, was Kraken’s Engineering Director. He managed a Solana validator with $75 million in delegated stake. His background in both blockchain and traditional finance will help manage token holdings and staking.

Marco Santori,Kraken’s former Chief Legal Officer,joins the board. He will guide Janover’s compliance efforts as it enters the crypto world. The original leadership team stays in place, focusing on the legacy real estate SaaS business.

Janover’s move to a crypto-backed treasury model is part of a growing trend. Companies like MicroStrategy and GameStop have also adopted crypto-focused strategies. Janover stands out as the first U.S. company to use Solana as its core asset.

SOL’s price has been volatile but is up 11% over 24 hours. This movement is influenced by broader market factors, including trade tariffs.